Canada Extends Work-Sharing Program to 76 Weeks Amidst Trade War

In light of the trade war unfolding between the U.S. and Canada, on March 7, 2025, the Government of Canada announced that Work-Sharing agreements entered into between employers and employees can run for a maximum of 76 weeks, up from a maximum of 38 weeks.

About Work-Sharing

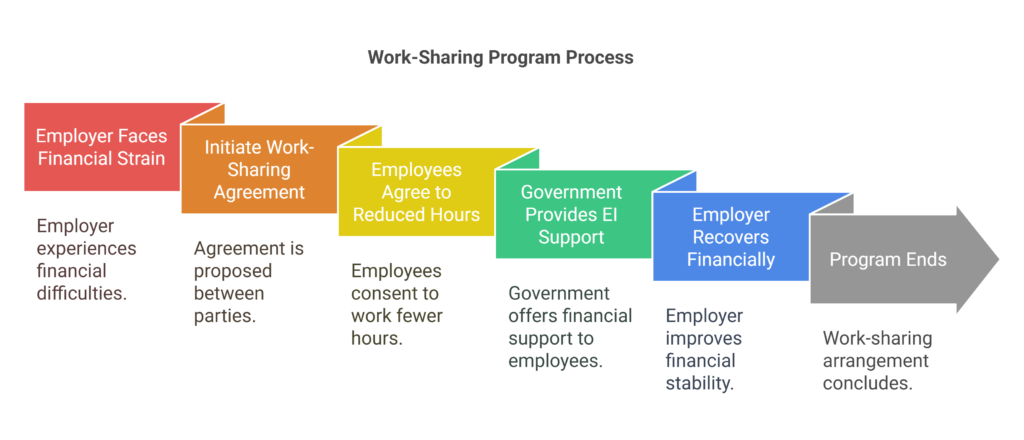

Work-sharing is an agreement between an employer, participating employees (and the union if applicable), and the Government of Canada. It provides income support to employees eligible for Employment Insurance (EI) benefits who work a temporarily reduced work week while their employer recovers from financial strain.

The program, administered by Service Canada, is designed to help employers avoid layoffs when there is a temporary decrease in the normal level of business activity and when the reduction is beyond the employer’s control.

Duration and Extension

Generally, Work-Sharing agreements run for a minimum of 6 weeks and can last up to 26 weeks. A 12-week extension is possible, which, if approved, would bring the maximum duration to 38 weeks.

However, the Government of Canada has implemented special measures, which (among other changes noted below) temporarily increase the maximum duration to 76 weeks. This extension applies to Work-Sharing agreements entered into between March 7, 2025 and March 6, 2026.

Eligibility

Under the special measures, employers who face a decline in business activity that is attributable to the threat, or realization, of U.S. tariffs may be eligible for Work-Sharing agreements if they have been operating in Canada for at least one year (temporarily reduced from two years), and if they have at least two EI eligible employees who agree to a reduction in hours and to share any available work.

In addition, the program’s eligibility has been temporarily expanded to include:

- Non-profit and charitable organizations that are experiencing a reduction in revenue levels as a direct/indirect result of the tariffs.

- Cyclical and seasonal employers.

- Employers who have experienced a decrease in work activity over the past six months of less than 10% (generally, a decline of at least 10% is mandatory).

- Employees who are deemed as essential in assisting their employer’s efforts to financially recover.

Cooling-off Period

Generally, employers cannot re-enter a Work-Sharing agreement with the same employees without waiting for a period of time. This is referred to as a cooling-off period. This rule has been waived while the special measures are in place.

Application

To apply for a Work-Sharing agreement, employers must complete two forms:

The completed and saved forms can then be sent via email to the employer’s respective Regional Work-Share Unit:

- Ontario: on.ws-tp.on.edsc@servicecanada.gc.ca

- Western Canada and Territories: wt.ws-tp.esdc@servicecanada.gc.ca

- Quebec: qc-dpmtds-lmsdpb-tp-ws-gd@servicecanada.gc.ca

- Atlantic Provinces: tp-atl-ws-tp.edsc@servicecanada.gc.ca

Additional Information

Service Canada has created an inquiry unit for employers that need general information related to the Work-Sharing Program. This unit can be reached via email at: edsc.dgop.tp.rep-res.ws.pob.esdc@servicecanada.gc.ca.

Employees who have questions about the Work-Sharing benefits may call the Employment Insurance Call Centre.

Do you have questions about how this applies to your business? Contact Us:

Our HR solutions experts can recommend the right mix of HR outsourced services to make your entry into Canada easier.

Our HR solutions experts can recommend the right mix of HR outsourced services to make your entry into Canada easier.  Pivotal Employment Management Services co-hires your workforce, simplifying entry of your business in Canada.

Pivotal Employment Management Services co-hires your workforce, simplifying entry of your business in Canada.